The modern internet runs on gatekeepers. Your bank mediates payments. A marketplace decides who can sell. A platform can mute your audience or change the rules overnight. Those central points of control are convenient—until they’re not. They introduce single-point failures, opaque fees, lock-in, and sometimes outright censorship. Decentralized applications, or dApps, exist to solve those problems at the root. Instead of trusting a company to hold the ledger, enforce the rules, and keep accounts safe, a dApp encodes rules in open smart contracts and relies on a public network to execute them as written. That design removes unnecessary intermediaries, makes enforcement auditable, and enables anyone to participate on equal terms.

This guide keeps the hype out and the usefulness in. We’ll explain what a dApp actually is, when it’s the right tool (and when it isn’t), how it’s put together in plain English, how to avoid the UX and security gotchas that sink many launches, and how to ship a credible MVP in 30 days. You’ll also get a realistic view of risks, regulation, and where the space is headed. By the end, you should be able to look at a product idea and decide—confidently—whether decentralization would solve a real problem for your users.

What a dApp Really Is

A decentralized application is just software with three familiar parts arranged differently. There’s a normal web or mobile front end that people use. There’s a set of smart contracts—programs deployed to a blockchain—that hold assets and enforce rules. And there’s a public ledger that records every state change. The front end talks to the contracts, and the network guarantees the rules run exactly as published, without an admin flipping a switch behind the scenes.

The difference from a typical app is where authority lives. In a centralized app, your company database is the source of truth and admins can change records. In a dApp, the chain is the source of truth and no single party can alter it. Some projects go “all on-chain,” but many useful products are hybrids: the asset transfers and core rules are on-chain, while the large files, analytics, and high-speed interactions live off-chain for cost and performance. That “web2.5” pattern is not a compromise—it’s often the sweet spot.

When a dApp Is the Right Tool (and When It Isn’t)

Decentralization is a means, not a religion. It shines when users need guarantees a single company cannot credibly offer. If your users need assurance that no admin can seize funds, change outcomes, or bias results, smart contracts are compelling. If your market suffers from rent-seeking intermediaries that take a cut for access, peer-to-peer settlement helps. If your community values portability—taking identity, balances, or reputation to any compatible app—an open ledger creates that option by default. And if you’re serving a global user base, programmatic money that settles worldwide without banks can remove huge amounts of friction.

On the other hand, if you’re building a standard internal dashboard, a low-latency game loop, or a workflow that needs to stay private by default, a blockchain won’t help. You’ll add cost, latency, and regulatory surface without delivering commensurate value. Use a simple decision lens: does removing a centralized intermediary directly reduce risk, cost, or unfairness for your users? Will an auditable, neutral ledger change behavior in your market? If the answer is yes, a dApp is worth exploring. If the answer is no, keep it simple.

The Problems dApps Are Built to Solve

Most value comes from eliminating failure modes introduced by central control. The first is intermediary risk. In many markets, the middleman is the market. They decide access, take a fee, and sometimes front-run or preference their own products. Automated market makers in decentralized finance replaced order-book gatekeeping with open pools and transparent formulas. Anyone can provide liquidity, anyone can trade, and fees are set by code rather than negotiation. That model doesn’t eliminate all risk, but it eliminates the need to trust a single venue.

Custody risk is another. When a platform holds customer funds, users rely on that platform’s security and ethics. Self-custody tools, multisignature treasuries, and smart-account wallets reduce that risk by keeping control with the user or the collective. Even for organizations that must custody funds, programmable safeguards—spending limits, time locks, and multi-party approvals—can turn human policy into enforceable code.

There’s also censorship and platform risk. Creators and communities routinely see policies change mid-stream. With programmable payouts in stablecoins and open social graphs, you can separate audience and income from any single platform. If a front end disappears or terms change, the underlying data and rules remain available to anyone who builds a new interface.

Finally, transparency matters in domains like grants, royalties, or carbon credits where claims need verification. On-chain records don’t solve off-chain truth, but they do create a tamper-evident trail of who did what, when, and under which rules. Pair that with attestations or zero-knowledge proofs and you can share just enough to prove compliance without broadcasting sensitive details.

A Plain-English Look at the Architecture

The smart contract is the beating heart. Think of it as a vending machine that anyone can inspect. You put a coin in, press a button, and it releases a snack—every time, for everyone, according to code. Contracts hold assets, enforce eligibility rules, split fees, route payouts, and emit events that outside tools can listen to. Different ecosystems use different languages—Solidity or Vyper for the EVM family, Rust for chains like Solana—but the core idea stands: rules are code, and the network enforces them.

The front end is familiar: HTML, CSS, JavaScript, a mobile framework—whatever your users expect. The difference is that instead of calling your private API, much of the logic calls contract functions and reads chain data. Users interact through wallets that hold keys and sign actions. Traditional externally owned accounts make the user manage a seed phrase; newer smart accounts improve that with email or social logins, recovery contacts, and sponsored fees.

Nodes and RPC providers are the pipes. Your app needs to read state and send transactions. You can run your own node for reliability or use a provider for convenience. Indexers turn raw chain events into queryable views so your app can load fast without scanning the entire history. Oracles safely bring in external data—prices, weather, or any fact the contract needs to know—using systems that reduce the risk of manipulation.

Choosing the Right Building Blocks

Network choice is a trade-off. The base layer offers the strongest decentralization but higher fees and slower throughput. Layer-2 networks anchored to a base layer cut costs and speed up confirmation while inheriting security. Alternative chains prioritize throughput with different architectures and sometimes different trust assumptions. Make the choice by starting with user need: what will a normal transaction cost and how quickly should it feel confirmed? What kind of decentralization does your use case require? How portable should assets be to other apps your users already care about?

For storage, blockchains are expensive databases. Keep large files and media on content networks like IPFS or Arweave and store only the content hash or pointer on-chain. For identity, human-readable names and verifiable credentials reduce friction and unlock rewards and reputation without “account soup.” For privacy, resist the temptation to hide everything in a mixer and call it a day. Use selective disclosure and zero-knowledge proofs where appropriate so users can prove facts about themselves or a transaction without exposing the underlying data. For interoperability, assume your users will want to move assets and reputation across chains or apps. Favor standards and battle-tested bridges or avoid bridges entirely by building where your users already are.

Fixing the UX: Onboarding, Fees, and “What Chain Am I On?”

The usability gap—not the tech—is what keeps most dApps niche. Seed phrases scare normal people. Paying transaction fees in a token they don’t recognize creates cognitive overhead. Submitting a transaction and seeing nothing for 30 seconds feels broken. You can fix all of that.

Account abstraction lets you offer email or social logins backed by smart accounts instead of raw keys. Users can recover access through trusted contacts or a hardware device rather than a 12-word spell. You can sponsor gas fees or let users pay in the asset they’re already dealing with instead of a chain’s native token. Session keys reduce the parade of signature popups. Transaction simulation gives clear “this is about to happen” previews with dollar amounts so users don’t feel tricked. If you do nothing else, build a crisp first-run experience: create account, fund or skip, complete one meaningful action in under two minutes with plain-language prompts that never mention jargon unless a power user asks.

Security and Risk: Non-Negotiables

Moving value with code raises the stakes. Bugs have real consequences. The biggest risks are well known: reentrancy attacks where a contract makes an external call and gets tricked into running a second time; arithmetic errors that overflow balances; oracle manipulation where an attacker distorts a reference price; upgrade paths that let an admin redeploy malicious logic; and permissions that are too broad.

The countermeasures are disciplined, not glamorous. Use audited, battle-tested libraries for common patterns. Keep contracts small and composable. Write unit tests and property-based tests that try to break invariants. Get an independent audit and be prepared to change code based on findings. Offer a real bug bounty and respond quickly to reports. Keep admin keys in multisig wallets with clear procedures and, where possible, timelocks so stakeholders can see changes coming. Above all, publish what you’ve done in normal language. Security through obscurity fails; security through transparency builds trust.

Tokens, Incentives, and Governance—Only When They Help

A token is not a strategy. It’s a tool for distributing control and aligning incentives, and it’s easy to get wrong. Many apps don’t need a token at all. If your product is a straightforward utility, price it in money and deliver value. Where tokens can help is governance, metering scarce resources, or aligning contributors over time. In those cases, emissions and vesting should reward actual contributions or usage rather than speculation. Tokens need sinks as well as faucets—places where users burn or lock tokens for real benefits—so the system doesn’t inflate away its own signal.

If you pursue community governance, design for participation. Off-chain discussion with on-chain execution, sensible quorum rules, delegation to capable stewards, and periodic cleanups of dead proposals keep systems from decaying into apathy. And wherever you land on incentives, take compliance seriously. Airdrops and referral programs are not loopholes. Make honest disclosures about risks and avoid implying guaranteed returns.

Performance and Cost in the Real World

Users experience performance as a feeling: did the app respond to me, or did it stall? The chain’s confirmation time matters, but so do your front-end choices. Optimistic updates that reflect expected results fast and gracefully handle rare reversions keep flows snappy. Batching operations reduces fees. Writing to storage less and emitting events more keeps costs down. If you’re targeting a base layer, help users plan around variable fees. If you’re on a faster, cheaper network, don’t treat it as an excuse to be sloppy. Efficiency is part of product quality.

Monitoring closes the loop. Track failed transactions, estimate slippage, watch for stuck mempool items, and alert on unusual patterns. If an upstream provider falters, have a fallback. Post-mortems for visible incidents, even when the root cause was outside your control, demonstrate maturity.

The Developer Toolkit (Minus the Hype)

You don’t need exotic stacks to build a reliable dApp. On the contract side, scaffolding frameworks compile, test, and deploy with sensible defaults. Static analyzers catch common foot-guns. Fuzzers try weird inputs you would never think of. On the front-end side, lightweight libraries make wallet connections and contract calls feel like normal hooks. Starter kits integrate readable wallets, social logins, and safe signing prompts. Indexers turn chain events into friendly queries, while simulators and debuggers show the exact state changes before you spend a cent.

Set up a target you can repeatedly hit: a reproducible local test chain, a staging deployment, a canary on testnet that you update first, and a simple continuous integration pipeline that runs tests automatically. None of this is unique to web3; it’s just good engineering practice adapted to a new execution environment.

A Credible 30-Day MVP Plan

Week one is about clarity. Write the problem in a sentence ordinary people understand. Draw the core flow with a sharpie: who does what, and what must be on-chain for the promise to hold? Pick a network based on user need, not fashion. Define the trust model in plain language—what users must trust you for and what they don’t. Draft the contract interface and a minimal front end that does exactly one valuable thing.

Week two is about making it real. Implement the smallest possible contract that enforces the core rule and nothing else. Write tests until you’re bored, then write two more. Build the front-end screens to connect a wallet, run the action, and display a success state that shows precisely what changed. Wire in a simple indexer so the page loads instantly with known information. Invite three non-crypto friends; watch them click around and narrate. Anything confusing becomes a design task.

Week three is about polish and safety. Replace placeholder copy with normal words. Add transaction simulation and clear previews. Implement a sensible recovery flow. Publish a brief security readme that documents dependencies and permissions. Stand up basic analytics that measure real behavior: how many people reach the success state, how long it takes, where they drop. Make a demo video that shows one run end to end with no cuts.

Week four is about shipping with integrity. Get a quick audit or at least a thorough independent review of changes since week two. Fix what matters and cut what doesn’t. Deploy to mainnet or your chosen L2. Publish docs with a FAQ that answers the scary questions directly. Add an in-app “report an issue” link. Turn on alerts. Announce quietly to a relevant community before you trumpet widely. Your goal is to learn with the least drama possible.

Go-to-Market That Respects Users

Distribution isn’t “post it and pray.” Start with people who feel the pain your app solves. If you’re helping creators get paid reliably, your first users are creators who already talk about payment issues. If you’re reducing settlement friction for DAOs, talk to treasurers in public forums who complain about that friction. Offer a clean explainer, a real product demo, and one low-risk way to try it.

Incentives should align with ongoing use rather than one-time grabs. Referral codes that share fees or boost limits for both referrer and referee are better than cash bounties that attract bots. If your product benefits from liquidity or participation, prime the pump with your own resources but design for sustainability. Measure what matters: retained users after 7, 30, and 90 days; the number of meaningful on-chain actions per user; the revenue or savings users actually realize; and the number of safety incidents (which should be zero).

Patterns from the Field

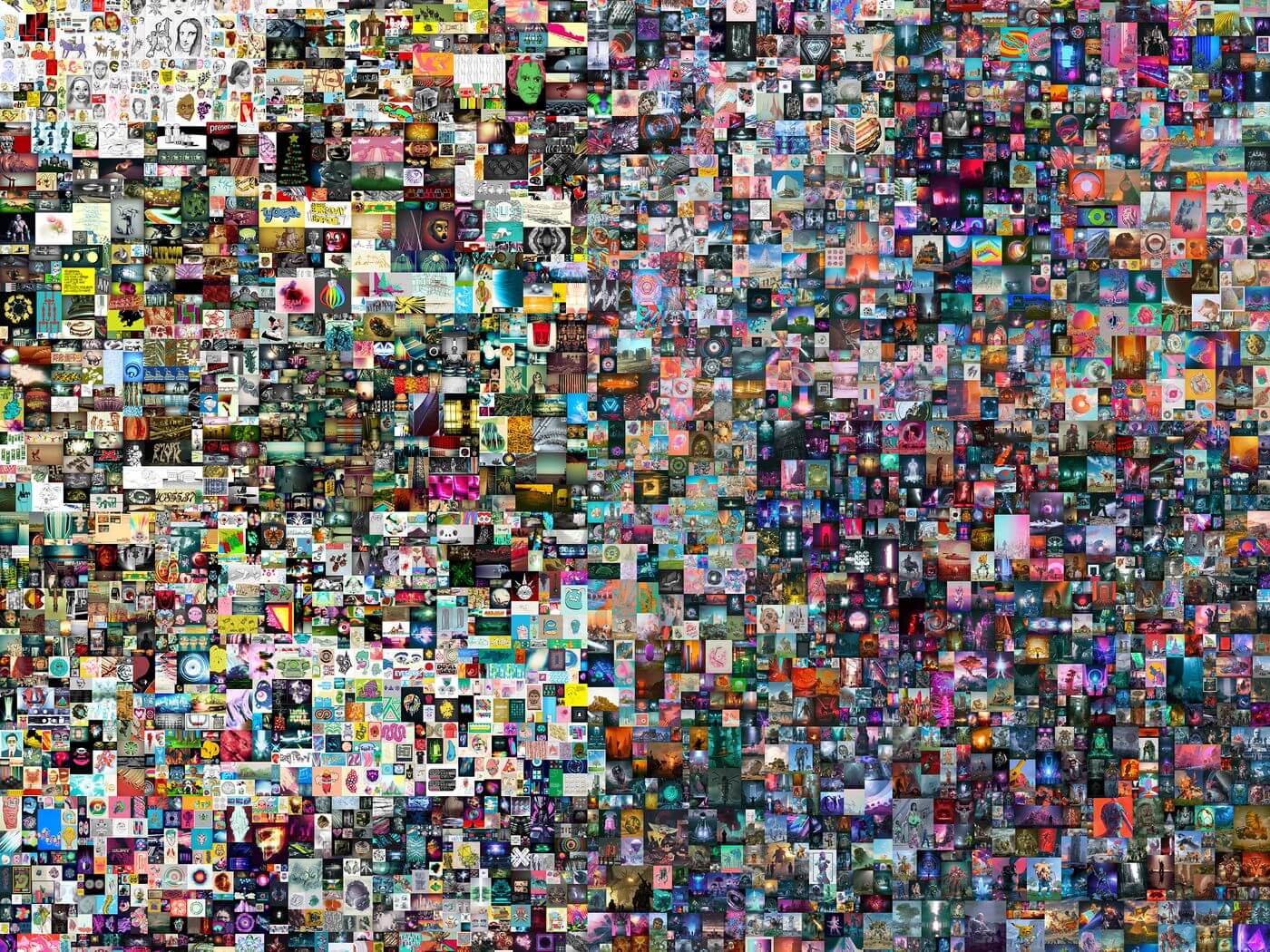

Decentralized finance demonstrated that you can replace gatekept market venues with rules anyone can inspect. Automated exchanges and permissionless lending aren’t free of risk, but they made markets more open and composable. Creative economies showed that provenance and programmable royalties change incentives for artists and communities, especially when paired with membership benefits rather than speculation. Open social graphs proved that identity and relationships can outlive any one app, lowering the fear of “building on rented land.” In gaming and virtual worlds, keeping high-speed gameplay off-chain while putting scarce assets on-chain gave players real ownership without sacrificing performance. In supply chains and climate markets, on-chain attestations plus selective disclosure created audit trails that regulators and partners can actually verify.

Compliance and Legal Reality

There is no decentralization exemption in the law. If you move money, someone will want to know how you’re handling identity, sanctions, and consumer protection. The good news is that you can align with these requirements without centralizing everything. Keep KYC and AML checks at the edges where money meets banks. Be honest about fees and risks in normal language. Avoid claims you can’t substantiate. For incentive programs and airdrops, write disclosures as if a regulator and your grandmother will read them on the same day. And get counsel early—clean architecture beats crisis management.

Avoid These Common Mistakes

The easiest way to fail is to ship a token and call it a product. Tokens don’t create demand; solving a problem does. Another frequent error is wrapping a centralized system in the word “decentralized” while an admin key can move funds or halt operations without oversight. Users aren’t fooled for long, and auditors will flag you. Many teams also neglect UX, assuming crypto-native flows are “good enough.” They’re not. Normal people need normal words and predictable steps. Finally, don’t hide your security posture. Publish what contracts you use, what audits you’ve passed, how keys are held, and how to revoke approvals. Silence reads as risk.

What’s Next: Trends Worth Caring About

Account abstraction will make wallets feel like apps rather than safes, with logins, recovery, and autopayments that fit how people actually behave. Intent-based transactions will let users express “what” they want to do while smart solvers figure out the best “how,” reducing failed transactions and choice overload. Zero-knowledge proofs will move from novelty to utility, enabling private compliance and verifiable compute without dumping sensitive data on-chain. Modular architectures and app-specific chains will let teams tune cost and performance without forking away from the ecosystem that matters to their users. Real-world assets—done credibly, with programmatic compliance—will connect on-chain rails to off-chain cash flows. And consumer protections will mature, from standardized disclosures to protocol-level insurance, making the space safer for people who don’t live on Crypto Twitter.

Bringing It All Together

Decentralized apps are not magic. They are a different way to allocate trust. When a market is distorted by intermediaries, when users bear custody and censorship risk they didn’t choose, or when verifiable fairness matters, encoding rules in public and enforcing them by network is a meaningful improvement. When the job is just “move some data from A to B,” traditional stacks are faster and cheaper. The craft is knowing the difference, then executing with humility: build the smallest useful thing, explain it in plain language, remove friction relentlessly, harden security before you scale, measure outcomes that matter, and let real user behavior—not narratives—steer what you do next.

If you’re weighing whether a dApp is the right tool for your product, start with a sentence about the risk or unfairness your users face today. Decide which part of that risk you can eliminate with code and shared infrastructure. Map one end-to-end experience that delivers a clear, verifiable win. Build to that and nothing else. If the result is valuable, you’ll have the only hype that matters: returning users who tell other people it solved their problem.